Accept a Better Financial Experience With Credit Unions

In a financial landscape driven by profit margins, credit scores unions offer a revitalizing option for individuals looking for a much more member-centric banking experience. Allow's explore exactly how credit report unions redefine the conventional financial connection and foster a feeling of belonging for their members, developing a cooperative partnership that goes beyond plain deals.

Benefits of Cooperative Credit Union

Credit scores unions use a range of benefits that establish them apart from traditional financial institutions and economic establishments. Credit rating unions are not-for-profit organizations owned by their members, enabling them to prioritize offering competitive prices and individualized client service.

Another advantage of cooperative credit union is their community-oriented nature. Lending institution are deeply rooted in the neighborhoods they serve, often returning with monetary education programs, sponsorships, and area occasions. This regional focus cultivates a sense of belonging and solidarity amongst members, developing a helpful monetary atmosphere.

Reduced Charges and Rates

Among the variety of benefits lending institution offer, a notable advantage depends on the affordable prices and lower costs they offer to their members. Unlike standard banks that prioritize earnings for shareholders, lending institution are not-for-profit organizations had by their members. This framework allows credit score unions to offer a lot more beneficial terms, consisting of lower rate of interest on finances, higher rate of interest prices on interest-bearing accounts, and reduced charges on numerous financial items and solutions.

One considerable location where credit scores unions master supplying lower charges remains in their checking accounts. Numerous credit unions provide cost-free monitoring accounts with little to no monthly upkeep fees, minimum equilibrium needs, or overdraft fees compared to banks. In addition, credit rating unions have a tendency to have reduced or no costs for ATM usage, overdraft account security, and global purchases.

When it comes to funding items, lending institution commonly supply reduced interest rates on credit history cards, home loans, individual financings, and auto car loans. This equates to cost savings for members over the life of the car loan compared to borrowing from conventional banks. Eventually, the reduced costs and competitive rates used by credit scores unions add to a more cost-effective and monetarily beneficial financial experience for their participants.

Customized Member Services

Enhancing the financial experience with tailored services, lending institution prioritize personalized participant interactions to meet individual economic requirements efficiently. By recognizing that each member has distinct economic objectives and situations, lending institution intend to supply personalized solutions that deal with these specific demands. From try this out personalized economic guidance to customized financing products and financial investment methods, cooperative credit union aim to offer a level of solution that surpasses simply basic banking demands.

One secret facet of customized member solutions is the focus on building strong relationships with members. Lending institution focus on being familiar with their participants directly, understanding their economic ambitions, and supplying assistance and assistance every step of the method. This customized strategy helps promote trust fund and commitment between the lending institution and its members, causing resilient and equally advantageous collaborations.

In addition, credit history unions commonly go the added mile to guarantee that members feel valued and appreciated. Whether it's with birthday celebration introductions, individualized account testimonials, or exclusive member events, cooperative credit union intend to make every interaction significant and tailored to the private participant's demands. This dedication to personalized solution collections cooperative credit union apart and adds to a better overall banking experience for their participants.

Area Participation and Assistance

Energetic involvement in neighborhood campaigns is a foundation of the values embraced by credit report unions, demonstrating a commitment to supporting neighborhood neighborhoods. Lending institution are deeply rooted in the areas they offer, commonly taking an active role in various neighborhood jobs and philanthropic endeavors. By participating in community involvement, lending institution foster a sense of unity and uniformity amongst their participants while likewise adding to the total wellness of the communities they operate in.

One of the key elements of area support by credit report unions is the promo of financial proficiency and education. Lots of credit scores unions use economic literacy programs, click over here seminars, and workshops to assist encourage people with the knowledge and skills needed to make audio financial decisions.

Financial Education And Learning and Resources

Economic education and learning plays a critical function in equipping people to make enlightened financial decisions and accomplish better economic security. Lending institution master giving valuable financial education and sources to their members. By offering workshops, seminars, online resources, and one-on-one counseling sessions, cooperative credit union make sure that people have accessibility to the knowledge and tools necessary to handle their funds effectively.

Among the vital advantages of economic education and learning provided by cooperative credit union is the concentrate on useful skills such as budgeting, conserving, spending, and credit score monitoring. These sources assist individuals create a solid click resources financial structure and make audio monetary choices that align with their objectives - wyoming credit union. Furthermore, lending institution usually collaborate with area partners and financial specialists to provide extensive and current details to their members

In addition, cooperative credit union prioritize economic literacy initiatives for any age groups, from youngsters to senior citizens, ensuring that participants at every life stage have the opportunity to boost their monetary knowledge. By spending in financial education and learning and resources, lending institution empower people to build a secure financial future and attain their long-term economic ambitions.

Verdict

To conclude, lending institution use an exceptional banking experience via their focus on member contentment, competitive rates, reduced charges, and personalized client service. By actively taking part in community campaigns, promoting economic proficiency, and supplying tailored economic options, debt unions enhance the relationship with their participants. Embracing the advantages of credit scores unions can lead to a much more meaningful and encouraging banking experience for individuals looking for a better economic future.

Rider Strong Then & Now!

Rider Strong Then & Now! Jurnee Smollett Then & Now!

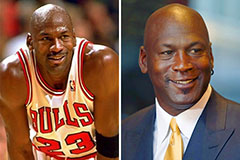

Jurnee Smollett Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!